AI and China will be the top themes for Meta Platforms’ quarterly earnings

I’ve been analyzing and commenting on Meta’s quarterly earnings since the company went public. Here’s what I’m watching when META reports Q1 2025 earnings this week.

AI Investment and Monetization

Meta’s enormous investment in AI infrastructure will continue to weigh heavily on investors when the company reports quarterly earnings on April 30, 2025. But Meta will resist directly monetizing AI this year, focusing instead on building AI usage among its app users, advertisers and developers using Llama.

The risk for Meta in waiting to monetize is that OpenAI and its ChatGPT will continue to pull further and further ahead. ChatGPT already has huge brand awareness among consumers, and OpenAI is likely to start monetizing it this year. While Meta can still create monetization opportunities by inserting ads into the AI features that are embedded into its apps, it will need to come out with a highly competitive and engaging standalone app if it wants to compete with ChatGPT.

As I told CNBC this morning: “ChatGPT has such wide brand awareness that it’s become a moat that is soon going to be very hard to overcome.”

Tariffs and Ad Revenue

Q1 was likely another solid quarter for Meta, because the impact of tariffs hadn’t yet kicked in. Q2 will be a different story, as investment from China-based advertisers is likely to plunge. MoffettNathanson estimates as much as $7 billion in ad spending could be at risk.

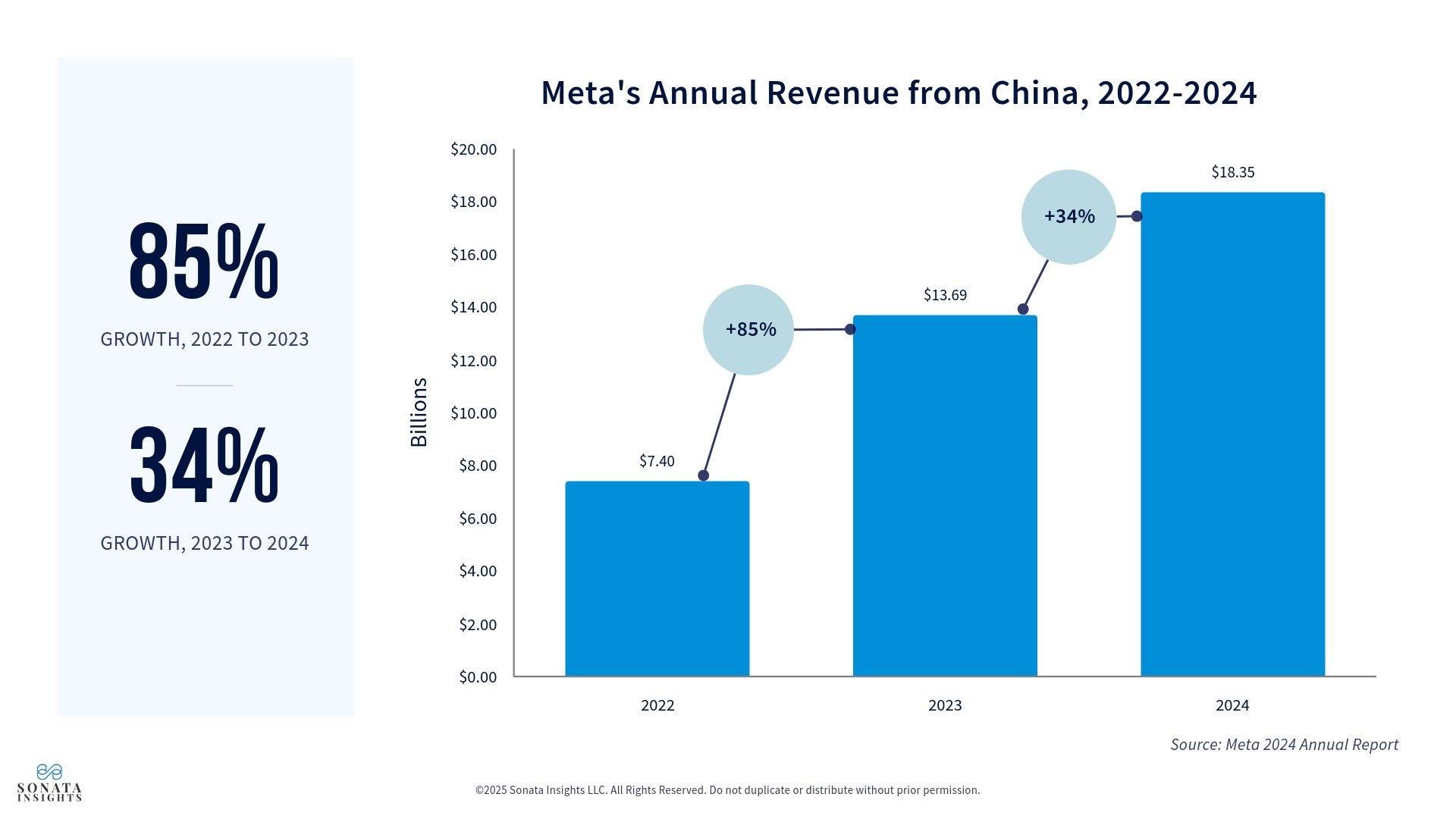

But revenue growth from China was already slowing down in 2024, making the impact of tariffs perhaps not as strong as they could have been. According to Meta’s 2024 annual report, revenue from China companies amounted to $18.35 billion in 2024, $13.69 billion in 2023 and $7.40 billion in 2022.

Antitrust Trial

I believe the FTC will have a difficult time proving its monopoly case against Meta. The social media market is large and sprawling and while Meta does enjoy a huge advantage when it comes to revenue, its advantages in consumer usage are (somewhat) smaller.

I also believe Meta’s open-source AI could come to its defense in the historic antitrust trial. Once upon a time, Mark Zuckerberg proclaimed that Facebook’s mission was to make the world more open and connected. But its social networks operate as walled gardens. When Meta introduced Llama, it purposely made it open source, allowing any developer to build on top of it. I believe promoting an open-source Llama is part of a plan to position the company as open and connected. Will it be the deciding factor in the FTC antitrust trial against Meta? Probably not. But I believe it will come up.

Threads Impact on Ad Revenue

Meta’s advertising business is still performing strongly, and it reached an historic milestone in Q4, reaching $46.8 billion. Meta’s move to launch ads in Threads will give advertisers another surface to deploy. However, Threads won’t be a meaningful contributor to ad revenue in 2025. Although Threads is starting to show signs of more traction among users who are gravitating back toward text-based social media engagement, the evolution of advertising in Threads is likely to follow a slow trajectory (as Reels and Stories ad revenue did).

Reality Labs

Meta’s Reality labs investments will continue to weigh heavily on investors. Mark Zuckerberg will have to be very persuasive to convince the market that these huge expenses are going to pay off eventually.

What I’m Watching in the Earnings Call

1) Llamacon news and how Meta execs defend their capital expenditures related to AI infrastructure

2) Changes to Meta’s content moderation policies, and how they might impact usage and ad revenue

3) How advertisers are deploying new AI tools such as video-ad editing

4) Meta’s plans for monetizing consumer AI (i.e., how soon it will incorporate ads into AI features on its platforms, its plans for a standalone app, and/or fee-based AI features)

5) How Reels usage is trending after the turmoil over the potential TikTok ban in the US.